Our weekly newsletter covers news, industry perspectives, and updates from the USBC ecosystem. Check out our last report here.

This week:

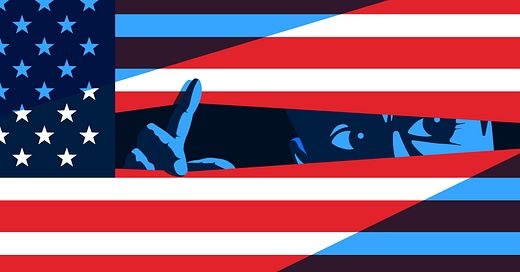

How the government killed Signature Bank (and why)

Stuff happens

1. How the government killed Signature Bank (and why)

We’ve extensively covered the politicization of the banking system—sometimes referred to as Operation Choke Point. For instance, there’s the time when regulators essentially killed crypto-focused Silvergate Bank by limiting their deposits from digital assets, setting a cap at 15 percent. (The FDIC has since reversed that position along with other anti-crypto requirements.)

Court documents have since confirmed the gatekeeping of certain blacklisted industries, whereby entrepreneurs were systematically kicked out of the banking system.

But perhaps the most sinister of all was the manufactured shuttering of pro-crypto Signature bank, a bank which board member Barney Frank argued was solvent the entire time, which we shared back in 2023. (Yes, the same Frank from Dodd-Frank.)

Nic Carter has now followed up with an extensive report on Signature’s demise.

First, Signature was no Silvergate. While it had exposure to crypto, it had a diverse business and client base along with a robust balance sheet:

Signature wasn’t like SVB — a specialized bank that served startups and VCs. Signature didn’t have the same flighty depository base of early-stage tech companies. The New York bank’s clients hailed from fairly quiet sectors like law and accounting, healthcare, manufacturing, and real estate. Signature had onboarded some crypto depositors, but that only represented 18 percent of its depository base. Though Signature was experiencing a run on Friday, it was fundamentally at less risk of insolvency due to its asset portfolio and “stickier” depositors.

As of Friday morning, not only was Signature’s financial position still robust — it actually experienced a net inflow of deposits despite the run on SVB. That day, the bank had $4.5 billion in cash, $26 billion in marketable securities, and around $29 billion in borrowing capacity (lines at the Fed and collateral pledged to the Federal Home Loan Banks (FHLB)) — all of this against around $89 billion in total deposits. Between the cash and lines of credit, they had around $33.5 billion in short-term liquidity. After the SVB closure on Friday, they immediately suffered a $2 billion outflow. Between 4 and 6 p.m. Eastern Time, they were down another $16.6 billion. Still, this did not put them in a state of illiquidity.

So why was Signature forced to fail? For former Congressman Frank, it’s about politics:

Some believe Signature was a political target due to its crypto affiliation, and at the margin, this may have made it a more attractive takeout candidate. Barney Frank was adamant this was the case, telling The New York Times,¹⁹ “I think we were shot to encourage the other [banks] to stay away from crypto.” And undeniably, by forcibly shuttering Silvergate and Signature — alongside their crypto settlement networks, Silvergate Exchange Network and SigNet — regulators dealt the crypto industry a huge blow.

I asked Barney Frank whether his view had changed in the two years since Signature’s collapse. Quite the contrary, he told me. His view that it was targeted due to its crypto business had strengthened, especially given the revelations in documents released in the Coinbase lawsuit against the FDIC, which revealed a long-running campaign against banks dealing with crypto.

But Carter sees a bigger picture. Crypto made Signature an easy target, but ultimately, it was used a pawn to save the politically important Silicon Valley Bank:

Though I’m sympathetic to the anti-crypto hypothesis, more evidence now points to the SVB bailout thesis as the FDIC’s primary motivation. (Though was Signature a casualty the FDIC was happy to accept, given the bank’s crypto business? Barney Frank certainly thinks that’s the case.) The main reason Signature was left high and dry — without regulatory assistance or the time to save itself — was to justify invoking the Systemic Risk Exception necessary to protect SVB depositors. Virtually everyone I spoke to with familiarity of Signature’s financials told me that the bank wasn’t insolvent — only marginally illiquid at worst. Opinions vary on whether Signature needed additional liquidity to make it through Monday or whether it would have been able to manage on its own.²⁰ Every source for this story was adamant Signature would have survived with the slightest accommodation from regulators — accommodations that were freely granted to other banks during the crisis.

The ultimate cause of SVB’s failure was the government’s massive COVID-era stimulus, which caused a 40-year high in inflation and subsequent interest rate hikes. These hikes collapsed the value of their fixed income portfolio. The proximal cause of the failure was Silvergate’s voluntary liquidation, which, as we’ve discussed, was triggered by an abrupt regulatory shift regarding deposits from crypto firms. Still, despite a historically rapid bank run, SVB didn’t need to messily collapse. Valid bids for the bank were turned away by FDIC’s Warren-installed Gruenberg, which would most likely have stopped the crisis from spreading further and prevented uninsured deposits from being liquidated.

The daisy chain continued. Signature was hung out to dry because allowing SVB to collapse — and with it, a huge fraction of the Bay Area startup sector — was either politically unacceptable with the approaching election year, economically disastrous, intolerable to Nancy Pelosi because of her husband’s business interests, or any/all of the above. The FDIC had to justify its Systemic Risk Exception with a non-California bank, and New York’s Signature was the sacrificial lamb.