Welcome to Yaka Stuff, our weekly newsletter that covers news, industry perspectives, and updates from the Hard Yaka ecosystem. Check out last week’s report here.

This week:

Web3 is flush with cash

The Disney of tomorrow

Who watches the Watchmen

Bored Ape’s web3 vision

DM of the week—outdated pitch deck edition

Web3 users learn how to trade

Tweet of the week—verifiable credentials edition

Stuff happens

1. Web3 is flush with cash

Yuga Labs, the team behind Bored Ape Yacht Club (that also now owns Cryptopunks), is worth $4 billion after raising $450 million in a seed round led by a16z.

Yup, that’s a seed round.

During web2, a year-old company with a dozen employees and a simple photo filter was valued at $1 billion based on the monetization potential of its fast-growing user base.

During web3, a year-old company with a dozen or so employees and a bunch of photos of apes is valued at $4 billion based on the monetization potential of its fast-growing ecosystem.

And yet, there’s the sense that Bored Apes still have quite a bit to prove—much more so than Instagram at the time of its Facebook acquisition.

Part of it is that Instagram represented something we understood. Bored Apes is a whole new paradigm.

That’s inherently cool. These early chapters of web3 have been really good at diverting tons of capital towards community projects that are promising to rewrite the rules of how we interact in the digital world.

But these are still promises. The bet here is on potential and future utility, which naturally sparks plenty of healthy skepticism.

Here’s the reality: The rise of crypto has enriched a generation of digital natives that are now reinvesting their digital money back in the ecosystem in order to build a future they’d like to be a part of.

Like the tech cycles that came before, most of these projects will fail.

But some could be the Google or Apple of tomorrow.

Relevant:

2. The Disney of tomorrow

Or Disney.

Here’s FTX’s Amy Wu speaking with Fortune:

In an interview, the head of FTX Ventures, a $2 billion fund that participated in the recent funding round, told me that Yuga Labs is, in fact, looking at the potential of becoming the House of Mouse—or, in this case, the House of Apes—for Web3, the decentralized, blockchain-dependent version of the Internet currently in its earliest of early days.

"Their North Star is Disney," Wu says. "They see themselves as holding valuable IP that they want to build, essentially, a media entertainment empire with. … Disney is what it is because of the culture it has created, and that’s what Bored Ape Yacht Club and the Yuga Labs team is trying to do."

And here’s Fortune:

However, with a growing collection of IP at Yuga Labs’ disposal, it’s a comparison that works quite well actually. Think about your Disney+ account, or the one that your sibling pays for that you grift on. The Mandalorian, WandaVision, Dug are all the IP of Star Wars, Marvel, and Pixar that was gobbled up over the years by Disney. Now imagine deploying that same model with NFT collections.

Yuga Labs is already moving in that direction, too. The company is currently developing a metaverse gaming project called Otherside that is designed to bring together the NFT community—Bored Ape holder or not—according to The Verge. CEO Nicole Muniz told the publication, which broke the fundraising news: “We’re opening the door to effectively a walled garden and saying, ‘Everybody’s welcome.'" A spokesperson for Yuga Labs declined to comment.

What Yuga's success will ultimately hinge on is a broader appeal to the Bored Ape universe. Putting the questions about the NFT model to the side, of which there are plenty, a single Bored Ape NFT costs several hundred thousand dollars, which obviously acts as a hard limit on who can buy them. And then there’s also the matter of how Yuga reaches people.

Easy:

“The consumer products, in addition to a beloved IP, is what can reach a mainstream audience,” Wu says.

“It was a no brainer to invest,” Wu says. “This is one of the most visionary projects happening in Web3.”

Relevant:

3. Who watches the Watchmen?

One of the internal conflicts that web3 is currently grappling with is its vision to democratize networks, economics, and content—among plenty of other things—and the reality of its venture funding.

(As first round investors in Solana as well as a bunch of other web3 projects, Hard Yaka is in the same boat.)

The same goes for Apes. Here’s Bloomberg:

Together, though, the ApeCoin and DAO have provided yet more grist for some of the harshest criticisms about venture capitalists’ influence and power in this evolving space.

Typically, the more tokens a participant has in a DAO, the more say they have over the group’s governance. And venture capital investors that helped with the launch, including Andreessen Horowitz and Animoca Brands, were some of the biggest recipients of ApeCoins. They and other launch partners received a collective 14%, or 140 million tokens, a spokesperson for Yuga Labs, the creator of Bored Ape Yacht Club, confirmed to Bloomberg.

These token holdings could grant Andreessen Horowitz and Animoca substantial influence over ApeCoin DAO, despite the fact that the group is supposed to be decentralized, with no specific entity in control. It’s these kinds of moves that have earned VCs the ire of people such as Block CEO and Bitcoin enthusiast Jack Dorsey. He tussled with Andreessen Horowitz’s Marc Andreessen and Chris Dixon on Twitter over VCs having too much influence over web3, which Dorsey claimed goes against blockchain’s tenets of promoting the distribution and decentralization of power. That said, many venture capitalists including Andreessen delegate the voting of their DAO stakes to organizations like student clubs in an effort to dilute their influence.

…

The ApeCoin launch is just a small illustration of how VCs are some of the biggest winners from crypto’s rise, after having collectively poured $32.5 billion into the industry in 2021, according to Pitchbook. Even if Andreessen Horowitz does sell off its ApeCoins, it’s already had a hand in creating ApeCoin DAO.

Relevant:

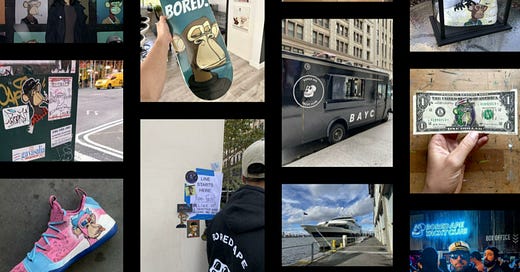

4. Bored Ape’s web3 vision

Protocol has a good overview of how the token drop went. Protocol’s takeaway:

The value of ApeCoin largely depends on how you view Yuga Labs’ future plans. Yuga Labs has said it plans to make ApeCoin a governance tool and the “primary token for the BAYC ecosystem, as well as future Yuga products and services.” Executives in the gaming industry from FTX and Animoca Brands already sit on the ApeCoin DAO’s special council, and the token is slated to be used as in-game currency for a slew of upcoming Yuga Labs releases. It’s worth noting that it doesn’t give away any ownership in Yuga Labs itself. That’s for founders and VCs to keep, of course.

Like many web3 projects, Bored Ape Yacht Club exists more as a vision than it does a software stack and robust network providing actual utility.

That’s not necessarily a knock. It’s the nature of where we are in this cycle. Despite all the hype and hoopla last year, these are still early days, and now that things have cooled off a bit, the focus will be on building.

Anyway, a leaked Yuga Labs pitch deck gives us a hint as to what that vision might look like (via /m).

Relevant:

5. DM of the week—Outdated pitch deck edition

From the Bored Ape Discord, according to VIP Graphics:

Relevant:

6. Web3 users learn how to trade

“A lot of web3 is people learning that trading is a thing for the first time.” A funny thing one of my colleagues said last week that’s grounded in a lot of truth.

I mean, the incentives are there. Here’s The Block:

An unknown user took advantage of the way the ApeCoin airdrop worked to glean $1.1 million worth of it for themselves.

They used a flash loan to borrow five BAYC NFTs, while also claiming the airdrop and repaying the NFTs — all in a single transaction.

Not too shabby.

Relevant:

7. Tweet of the week—verifiable credentials edition

Elsewhere in web3, Jay Scrambler’s tweetstorm on verifiable credentials (via /m):

Relevant:

8. This week in regulations

Crypto was supposed to transcend borders. Tell regulators that.

Bank of Japan enters second phase of CBDC experiments - Ledger Insights - enterprise blockchain

Feds Charge Two 20-Year-Olds In Alleged NFT Money Laundering, ‘Rug Pull’ Scheme

'A total disaster': Crypto firms face being booted from the UK as a key deadline approaches

U.S. Consensus Forming Over Stablecoin Oversight, Liang Says

El Salvador postpones bitcoin bond issue, expects better conditions

Australia Seeks Licensing of Crypto Exchanges Via Digital Services Act

FTX Launches Crypto Exchange Services in Australia - Blockworks

9. Stuff happens

Everyone Has Crypto FOMO, but Does It Belong in Your Portfolio?

BlackRock's Fink says Russia-Ukraine crisis could accelerate digital currencies

Crypto.com unveiled as FIFA World Cup Qatar 2022™ Official Sponsor

Receipt for invisible artwork by Yves Klein expected to fetch up to $551,000

Google to offer Spotify users alternate in-app payment method

Via /m—Terra (LUNA) Will Buy $10 Billion Worth Of Bitcoin. Here’s Why | Bitcoinist.com

Via /rcb—The Week’s 10 Biggest Funding Rounds: Blockchain Leads The Way As ConsenSys And Optimism Have Big Raises; Transportation Platform FLASH Parks Large Round

PBD Podcast | EP 128 | Patron Saint of Bitcoin: Michael Saylor

Ethereum has destroyed almost $6 billion worth of its own cryptocurrency on purpose. Here’s why.

Big Tech and fintechs extend grip on financial services - FSB

Goldman Sachs Makes ‘Milestone’ Crypto Trade With Galaxy Digital